Bad credit home equity loans texas

Short-Term Bad Credit Loans. A big hit like this will affect your ability to qualify for personal loans.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

But while home equity loans can be affordable theres a good chance theyll get more expensive in 2023.

. CreditNinja operates as a Credit Access Business 159810. Begin your debt free journey in 30 minutes or less. If you are in the middle of a home remodel and youre thinking of a tiny home or even a pole barn structure Acorn Finance can get you the financing you need.

Ask a Home Equity expert about obtaining a 1st or 2nd lien a Home Equity Line of Credit HELOC or a Home Improvement Loan to best fit your needs. A home equity loan lets you access an amount of cash based on your homes value. CreditNinja is licensed by the Delaware State Bank.

Borrowing rates could rise across the board. These loans all require that you have sufficient equity in your home generally between 15 and 20 and your approval will depend on your credit report combined loan-to-value ratio debt-to-income ratio. If you qualify you could be debt free in 26-60 months no loans no bankruptcy.

VA loans have the most generous credit score requirements. You can deduct the interest and property taxes You can deduct the mortgage interest for both your primary residence and second home up to 750000. Interest rates are slightly higher than for a primary mortgage but are very competitive.

Business Services Car Loans Checking Credit Cards Home Equity Investments Mortgages Personal Loans Savings CDs Student Loans Branches. California Colorado Florida Georgia Missouri New Hampshire New Jersey New York Ohio Texas Virginia show less. You dont need to be a first-time homebuyer to take advantage of the Homes Sweet Texas Home Loan program which offers 30-year fixed-rate mortgages and down.

Consolidate your debt using home equity. To learn more schedule a. See all best mortgage lenders by state.

No matter your credit score if you want to secure tiny home financing in California Texas Colorado or anywhere across the US Acorn Finance will. On home equity loans the minimum loan amount is 10000 and is repaid as a fixed-rate loan over a period of years. Purchase Loans Help you purchase a home at a competitive interest rate often without requiring a downpayment or private mortgage insurance.

Consolidate your debt using home equity. Cash Out Refinance loans allow you to take cash out of your home equity to take care of concerns like paying off debt funding school or making home improvements. Press Enter to activate tab.

The loan is secured on the borrowers property through a process. Homes Sweet Texas Home Loan Program. Bad credit student loans come with higher interest rates but there may be options to lower those rates such as by adding a co-signer.

Payday loans in the United Kingdom are a rapidly growing industry with four times as many people using such loans in 2009 compared to 2006 in 2009 12 million people took out 41 million loans with total lending. The 14 billion Chicago-based credit union founded in 1935 is one of the. Home equity loans with bad credit.

Capital One offers both home equity loans and home equity lines of credit HELOCs. You must have satisfactory credit. Caliber Home Loans of Coppell Texas offers mortgage products nationwide.

VA Loan Credit Score Requirements. Co-signers can be used for many different types of products including auto loans student loans home equity loans and home equity line of credit products. Consolidate your debt using home equity.

Home equity loans home equity lines of credit HELOC or cash-out refinance loans. Refinancing Refinance your mortgage with our low refinance rates and potentially lower your monthly mortgage payment Tab 4 out of 3. Theres no minimum credit scoreNo other mortgage offers this benefit but these loans are only open.

Home equity loans with bad credit. Mutual of Enumclaw Insurance. These loans also carry minimal closing costs in comparison to typical mortgage loans.

FHA loan Insured by the Federal Housing Administration FHA loans allow borrowers to buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score as low. When the federal funds rates increase it becomes more expensive for banks to borrow from other banks. The financial institution which serves 25 million members.

Home Equity Leverage the equity in your home and. There are several ways to tap into your homes equity. Consider a home equity loan.

Plus refinancing loans and home equity lines of credit. Home equity loans with bad credit. Elevate your Bankrate experience.

Press Enter to activate tab. The higher costs for the bank can mean a higher interest rate on your mortgage. Why LendingPoint is the best for small loans.

Mortgages Our home loans and low home loan rates are designed to meet your specific home financing needs Tab 2 out of 3. Plus refinancing loans and home equity lines of credit. The financial institution which serves 25 million members was established in 1935 and.

Get tiny home financing today without impacting your credit score. Home loans with variable rates like adjustable-rate mortgages ARM and home equity line of credit loans HELOC are indirectly tied to the federal funds rate. Consumers have been grappling.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Depending on your situation and the plan you choose you can lower your interest rates eliminate late and overlimit fees lower how much you owe and even improve your credit situation. A HELOC is a line of credit secured by the equity in.

Students loans for bad credit. If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. Some lenders with tighter credit requirements have a 5000 minimum for personal loans but LendingPoint lets bad credit borrowers take out as little.

Pros and cons of a second home mortgage Pros. The Financial Conduct Authority FCA estimates that there are more than 50000 credit firms that come under its widened remit of which 200 are payday lenders.

Can You Use Home Equity To Invest Lendingtree

Home Equity Loans Home Loans U S Bank

Home Equity Loans Pros And Cons Minimums And How To Qualify

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

9 Best Home Equity Loans Of 2022 Money

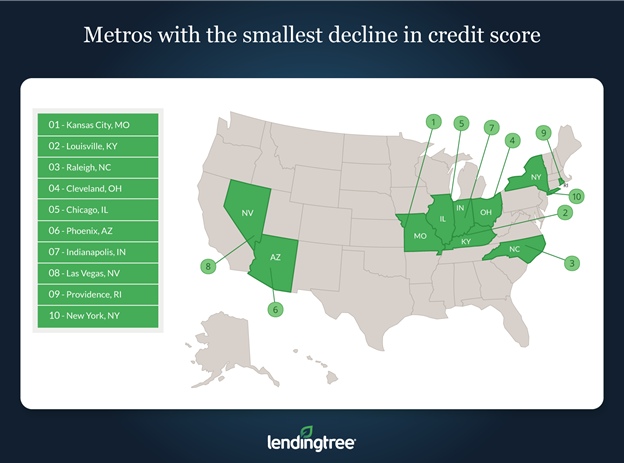

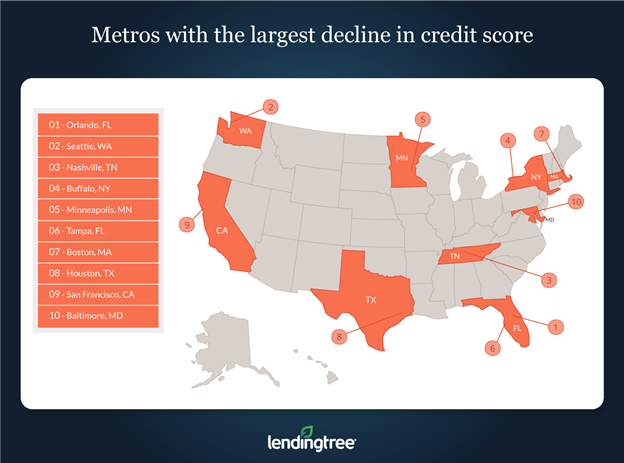

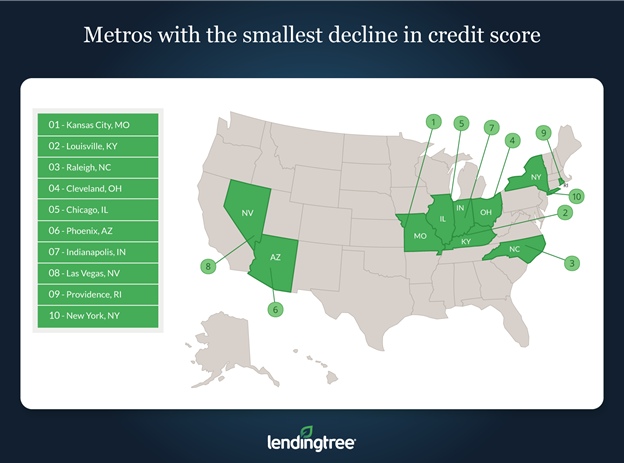

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

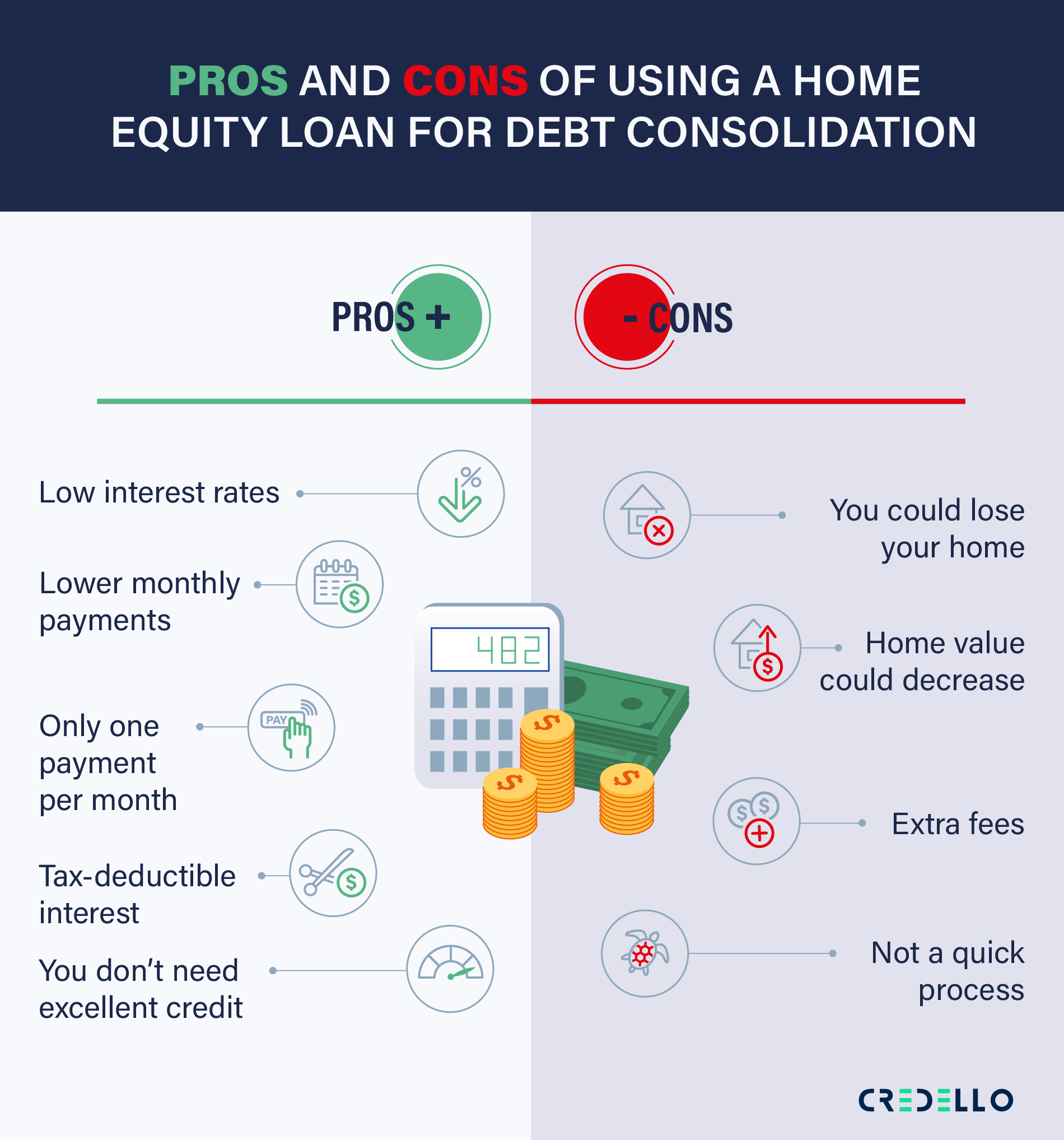

Should You Use A Home Equity Loan For Debt Consolidation I Credello

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

Qualifying For A Home Equity Loan With Bad Credit Lendedu

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Can I Get A Home Equity Line Of Credit With Bad Credit Credit Karma

Pros And Cons Of Home Equity Loans Bankrate

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

How To Get A Home Equity Loan With Bad Credit Forbes Advisor